Understanding the Meaning of Generosity in a Country’s R&D Tax Incentive Scheme

In most countries, the R&D Tax benefit is a ‘simple’ rate applied to R&D expenses incurred by a taxpayer, which make it easily understood.

You can foresee the approximate monetary value of R&D Tax Incentives that a country offers to support private R&D.

National regimes vary in clarity and require complex calculations to determine the “average” generosity rate.

- Portugal’s SIFIDE-II: The Most Generous Incentive Scheme in The Benchmark with Rates up to 82.5%

- Exploring Canada’s Advantageous R&D Tax Incentive Scheme for Small and Medium-Sized Enterprises

- Generous R&D Tax Incentive Offered by France for Companies in All Sectors

- Maximizing R&D Benefits in Spain: Up to 42& Returns

- Ireland ranks 5th in R&D Tax Incentives: All Companies Elegible for a 25% Tax Credit

In The Benchmark, Generosity has been calculated as a percentage, using working data from each of the 25 countries to create an estimate of the potential tax relief, taking into account the country’s general tax system, its characteristics and complexities.

The calculation of identified eligible expenditures provides an understanding of the monetary value received in return.

This value may be different to the tax credit percentage as it takes into consideration the complexities of each scheme and what qualifies as R&D expenditure.

Based on Ayming’s analysis of the incentives, here are the five countries which have the most generous benefit available.

Portugal’s SIFIDE-II: The Most Generous Incentive Scheme in The Benchmark with Rates up to 82.5%

Portugal is the most generous of the countries in The Benchmark, offering a basic rate of 32.5% and an additional rate of 50%.

The instrument used in Portugal is the SIFIDE-II, a hybrid instrument that allows companies to benefit from an increase in the rate, as long as they have not yet applied for compensation.

SIFIDE-II, which remains very attractive for companies, has been extended until 2025.

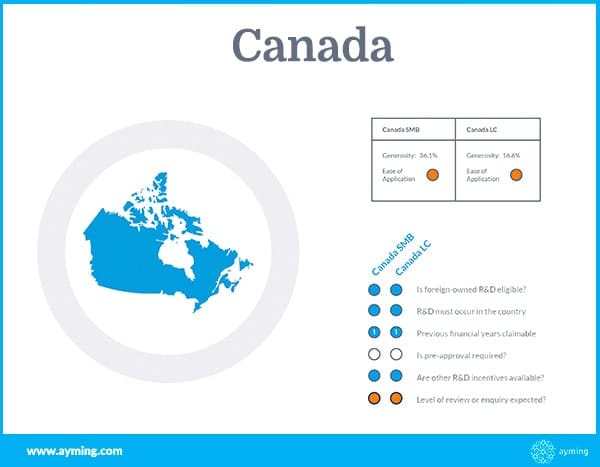

Exploring Canada’s Advantageous R&D Tax Incentive Scheme for Small and Medium-Sized Enterprises

Canada has a significant volume of public support for R&D, equivalent to 0.18% of GDP.

Canada’s scientific research and experimental development tax credit scheme is particularly advantageous for small and medium-sized enterprises.

This varies from 15% non-refundable to 54.5% refundable.

A percentage of 55% of eligible salaries are included in the expenses.

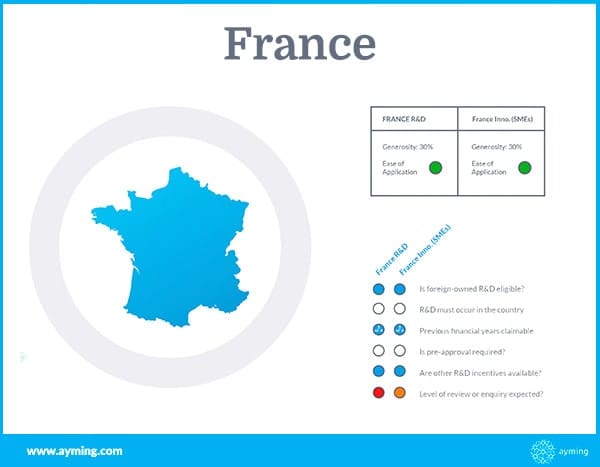

Generous R&D Tax Incentive Offered by France for Companies in All Sectors

France is one of the most generous countries in terms of R&D tax incentives.

The French tax credit offers 30% of R&D expenditure up to €100 million, then 5% above that, with additional eligible expenditure.

43% of personnel costs and 75% of capital costs are eligible, making the 30% rate even more generous.

Maximizing R&D Benefits in Spain: Up to 42% Returns

The Spanish scheme is one of the most unique in the world: firstly, it provides a tax relief of 25% of eligible R&D expenditure.

A 42% benefit can be added where expenditure exceeds the two-year average and a further 17% for staff dedicated exclusively to R&D.

A tax deduction of 12% is also available for all eligible expenses related to technological innovation activities.

Ireland Ranks 5th in R&D Tax Incentives: All Companies Eligible for a 25% Tax Credit

Finally, Ireland comes fifth in our list. The country offers a 25% tax incentive to all types of companies.

No Comments